- Extra payment mortgage calculator with amortization how to#

- Extra payment mortgage calculator with amortization full#

Extra payment mortgage calculator with amortization full#

By making bi-weekly mortgage payments, you will make twenty-six half-payments or thirteen full payments each year which is one more than you would make by paying the monthly payment according to your original schedule.Īnother option you might consider when your monthly salary raises permanently is to increase your monthly payment. But what does accelerated bi-weekly mortgage payments mean? It means that you make a half-payment every two weeks instead of a full payment once each month. One feasible way to accelerate mortgage payment is to turn to an accelerated bi-weekly or weekly repayment plan. In the following, we introduce four ways of making extra mortgage payments that you can also find in the present mortgage calculator with extra payments:

Extra payment mortgage calculator with amortization how to#

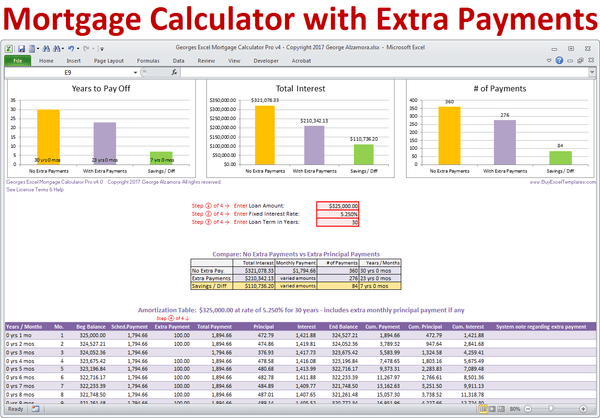

So, how to pay off a mortgage faster? There are multiple ways of paying extra on a mortgage to accelerate mortgage payment. Since making extra mortgage payments means additional payment on the principle, your mortgage balance will drop faster, resulting in a shorter repayment term and a lower interest cost. Since the such a long mortgage term is typically associated with not only higher uncertainty but a larger finance charge on the loan, you should consider accelerating your mortgage payment when your monthly salary increases. As you are at the beginning of your career path, you can expect a considerable improvement in your income. For example, let's assume that you just started working and took a 30 year mortgage. In finance, just like in personal life, many things can change over such a long time. The lifespan of mortgages typically stretches out over considerable time: the most common mortgage terms are 15 years and 30 years. If you are shopping around home loans, check our mortgage comparison calculator, which will give you great support in your decision-making. If you would like to include additional fees in your mortgage estimation, check our mortgage calculator with taxes and insurance, which gives you an excellent chance to analyze your loan with all extra costs. Mortgage calculator with extra payments and lump sum.Biweekly mortgage calculator with extra payments and.Mortgage calculator with multiple extra payments.You can also turn to an accelerated bi-weekly or weekly payments, which might also be a feasible way of paying less on the mortgage.īecause of all of the features in the additional mortgage payment calculator, you can apply our calculator as a:

With extra payments and a lump sum you can, for example, accelerate your mortgage remarkably. In the following, we show you how to pay off a mortgage faster, explain different ways for accelerated mortgage payments, and tell you what options you can find in the present mortgage calculator. You can also follow the mortgage balance's progress in the dynamic graph and read all of the payment details in the amortization table with extra payments. We designed a payment summary to provide you with a better insight by comparing the results with the original schedule and learning the differences between the two options. Please check out our biweekly mortgage calculator to understand more. You can also apply the tool to see how to pay off a mortgage faster by making extra mortgage payments by, for example, making one extra mortgage payment a year or by switching to an accelerated bi-weekly mortgage payment option. This tool gives you excellent support to find out how paying extra on a mortgage, in the form of extra principal payment, would affect your interest cost and repayment term. If you are looking for a mortgage with extra payments calculator (or an additional mortgage payment calculator), you've found the right place.

0 kommentar(er)

0 kommentar(er)